Silver…The New Gold!

Posted on | January 8, 2011 | 9 Comments

The talk the past few years has been about the bull run of gold, now hovering at about $1400 per ounce. I even talked about gold hitting $1000 per ounce in September 2009 in this post “Gold Spot Prices At 1000, What’s Next?” I also made a prediction in that post that is spot on!

What do I think? I don’t think $4-5000 per ounce is realistic any time soon, but $1200 – $1500 is possible in the next year. I definitely do not think that gold will go back to $500-600 per ounce as it was not too long ago.

Not bad, huh? Anyway, the metal that people aren’t talking about that has actually had a higher percentage rise than gold is SILVER. This week silver closed at about $28.70 per ounce and was hovering over $30 earlier in the week. In the past 10 years, silver has gone from approx $5 per ounce to $30 per ounce. That’s SIX times it’s value from January 2000. Here’s the chart:

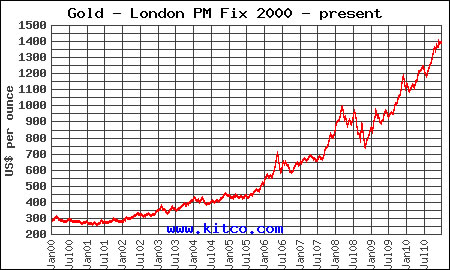

Gold has gone up way more, dollar wise, in 10 years – from $300 per ounce to $1400. However, that’s only 4.5 times. Here’s the 10 year gold chart:

So, despite all of the gold talk, silver is cruising! My prediction? Well I don’t have a crystal ball, but I see silver holding at $25-$30 an ounce and creeping up to $40 is certainly possible. With the world economy the way it is, we’re pretty bullish on metals. The Dow Jones has done NOTHING the past 10 years. However, our philosophy on gold and silver is that we don’t hold anything. We buy aggressively, make a small profit and move on to the next deal. Do not speculate because silver can go back down to $15 an ounce just as easily as it went up. If you have silver bars, silver flatware or silver coins, it’s a GREAT time to sell. Check out this video we made about selling sterling silver flatware and please contact me – I’m a buyer!

Tags: gold charts > gold predictions > gold spot prices > sell gold baltimore > sell silver > sell silver baltimore > sell silver coins > sell silver dimes > sell silver dollars > sell silver flatware > sell silver halves > sell silver maryland > sell silver nickels > sell silver quarters > sell silver virginia > sell silver washington > sell silver washington dc > silver charts > silver market > silver predictions > silver spot prices